27/2014: Precept Proposal for 2015/16 to the North Yorkshire Police and Crime Panel – 30 January 2015

Executive Summary and recommendation

Legislation requires that the Police and Crime Commissioner (PCC) agrees their budget and associated precept and basic council tax for the forthcoming year before 1st March each year. However before doing so the PCC must notify the relevant Police and Crime Panel of the precept which they propose to issue for the following year.

Police and Crime Commissioner decision

To propose that the Band D Police Element of the Council Tax within North Yorkshire for 2015/16 is set at £212.77. This is an increase of £4.15, or 1.99% over the 2014/15 level and is supported by 64% of the 1,527 who responded to my survey on this subject.

Police and Crime Commissioner decision: Approved

Signature:

Date: 30 January 2015

Title: Police and Crime Commissioner

Part 1 – Unrestricted facts and advice to the PCC

Report of the Chief Financial Officer of the PCC to the Police and Crime Commissioner for North Yorkshire

27 January 2015

Author: Mr Michael Porter, CFO

Status: For decision

Proposing the 2015/16 Precept

1 Purpose

1.1 Legislation requires that the Police and Crime Commissioner (PCC) agrees their budget and associated precept and basic council tax for the forthcoming year before 1st March each year. However before doing so the PCC must notify the relevant Police and Crime Panel of the precept which they propose to issue for the following year.

1.2 This report establishes the Council Tax Base and presents 2 options of precept for the forthcoming year.

1.3 The report summarises the results of the consultation undertaken by the PCC on the subject of the precept for 2015/16, where 64% of the 1,527 people who responded to the survey stated their preference for a 1.99% increase and 33% stated a preference for a precept freeze.

2 Recommendations

2.1 The PCC is asked to agree the 2015/16 tax base as 282,223 Band D Equivalent properties.

2.2 The PCC is asked to agree one of the following options on the Precept for 2015/16, and the associated financial implications which are detailed in Appendix A – Precept Options, which will then be proposed to the Police and Crime Panel:

- Option 1 – A Precept Freeze

- Option 2 – A Precept increase of 1.99%

3 Reasons

3.1 Agreeing the Precept

The balance of cost of the police service not paid for by central government is met by local taxpayers through a precept on their council tax. In North Yorkshire this will equate to just over 41% of the overall income to be received by the PCC in 2015/16. It is the responsibility of the eight local billing authorities namely, Craven District Council, Hambleton District Council, Harrogate Borough Council, Richmondshire District Council, Ryedale District Council, Scarborough Borough Council, Selby District Council and York City Council to collect this.

3.2 Legislation requires the precept for 2015/16 to be set before 1st March 2015. The precept on each of the eight billing authorities is set taking account of their individual surpluses/deficits on collection funds.

3.3 The PCC’s attention is drawn to the following:

- The police and crime commissioner must notify the relevant police and crime panel of the precept which the commissioner is proposing to issue for the financial year (the “proposed precept”) by the 31st January 2015.

- A Police and Crime Panel (PCP) can veto the proposed precept from the PCC if 2/3rds of the Membership of the panel vote to do so. In the case of the PCP for North Yorkshire 9 out of the 13 Members would have to vote against the proposed precept for it to be vetoed.

- The PCP are required to issue a report to the PCC on the proposed precept, by the 8th February 2015, including any recommendations that they may have on the proposal and also whether they have voted to veto the proposal.

- If the PCP do not veto the proposed precept:

The PCC must:

- Have regard to the report made by the panel including any recommendations in the report,

- Give the panel a response to the report and any recommendations; and

- Publish the response.

The PCC may then:

- Issue the proposed precept as the precept for the financial year, or

- Issue a different precept, but only if it would be in accordance with a recommendation made in the report to do so.

- If the PCP veto the proposed precept then the PCC must not issue the precept and further steps must be undertaken in line with the precept legislation.

- A police and crime commissioner may not issue a precept under section 40 of the Local Government Finance Act 1992 for a financial year until the end of this scrutiny process is reached.

3.4 The Tax Base

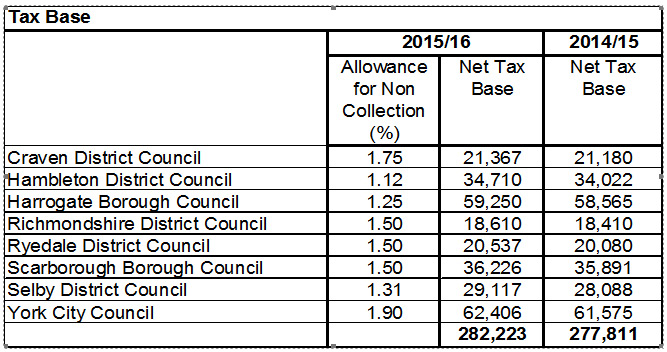

The eight local Councils have notified the PCC of their tax bases for 2015/16 as set out in the table below:

3.5 The tax base is expressed in terms of Band D equivalent properties. Actual properties are converted to Band D equivalent by allowing for the relevant value of their tax bands as set down in legislation (ranging from 2/3rds for Band A to double for Band H; discounts for single person occupation, vacant properties, people with disabilities etc;) and a percentage is deducted for non-collection. Allowance is also made for anticipated changes in the number of properties.

3.6 The tax base calculated by the billing authorities differ from the figures used by the Government (which assumes 100% collection) in calculating Grant Formula entitlements.

3.7 As can be seen from the table above the number of Band D equivalent properties across North Yorkshire has increased in 2015-16, in comparison to 2014-15, by 4,412 – this equates to an increase of 1.6%.

3.8 The financial impact of this permanent increase in the number of calculated Band D properties of 4,412 is a recurring increase in precept funding of £920k from 2015/16 onwards, which could aid to reduce budget reductions and savings.

3.9 The PCC is asked to agree the 2015/16 tax base as 282,223 Band D Equivalent properties.

3.10 Setting the Council Tax

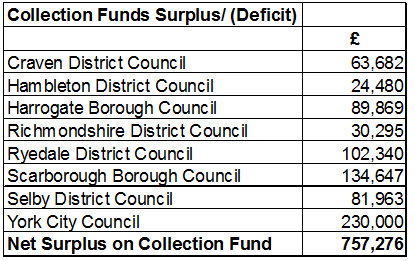

The precept calculation needs to take account of any net surplus or deficit on the billing authority collection funds. Projected surplus/deficits on the individual funds are shown in the table below.

3.11 The surpluses that have arisen need to be returned through the precept. The final precept to be levied will reflect the position on each council’s collection fund.

3.12 In the 6 years prior to the Localisation of Council Tax benefits, the overall surplus on the collections funds of the 8 Councils, average just under £140k per annum. In 2014/15 the collection surplus increased to £385k and as can be seen from the above table the amount to be paid in 2015/16 is over £750k.

3.13 This results, in part, from more information now being available on the impact of the Localisation of Council Tax benefit scheme, the implementation of new powers on council tax and tax base growth. There is however no guarantee that this level of surplus will continue into future years and therefore the current financial plans do not assume any surplus/deficit on the collective collection funds across the eight councils.

3.14 Precept Options

The options around Precept for 2015/16 seek to provide the PCC with the realistic choices that they have in relation to proposing a Precept to the PCP.

Option 1: Precept Freeze

3.15 The Government has offered a Grant, which will be received in 2015-16 only based on current correspondence, that is the equivalent to a 1.0% precept increase based on the Council Tax base before the adjustments made in relation to the Localisation of Council Tax Support policy, to all Police and Crime Commissioners that choose to freeze, or reduce, Council Tax levels from those in place for 2014-15.

3.16 This Grant, if the PCC chooses to freeze precept for 2015-16, is expected to be for £640k and is only expected to be received in 2015-16.

3.17 In a letter dated the 15th January 2014 it was stated that “Ministers have agreed that the funding for 2014-15 (including 2015-16) freeze grant should be built into the spending review baseline. This gives as much certainty as possible at this stage that the extra funding for freezing council tax will remain available.” And that the “Funding for 2011-12 and 2013-14 freeze grants is now in the local government settlement total for future years.

3.18 This position was re-iterated in a letter to PCC’s in December 2014 as part of the 2015/16 settlement process. It is important to realise that while this paper focuses on Precept, and forecasts that the Precept Grant will only be received for one year, the indication from the Government is that the Grant will then become part of the PCC’s core Police Grant.

3.19 There is a risk therefore that by not accepting the grant that the PCC is ‘turning down’ around £600k of permanent government funding, however there are no guarantees that this grant will become part of Core Funding. The only Precept Grant that has ceased being paid since they were introduced, which happened prior to the commitment given about them being built into the spending review baseline, was not added to the Core Funding of those that has previously accepted this grant.

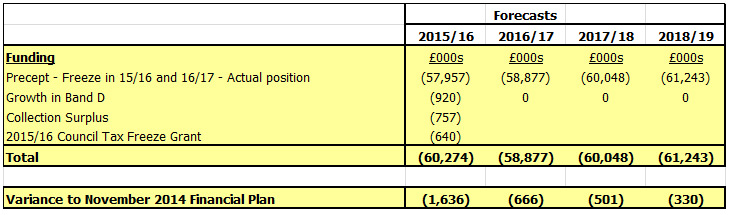

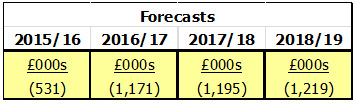

3.20 The planning assumption for the 2015-16 budget and the wider LTFP is based on the precept being frozen in both 2015/16 and 2016/17 and then increasing by 1.99% per annum thereafter. The financial plans, as at November were based on precept being received at the levels outlined in the table below:

3.21 Given the increases in Tax Base reported by the local councils, as per paragraph 3.4, the collection surplus that will be payable to the PCC in 2015/16, as per paragraph 3.10, and the offer of a Grant in 2015/16, the forecast precept levels for the next 4 years, based on a freeze in 2015/16 and 2016/17, and a 1.99% increase thereafter is now as follows:

3.22 Given the significant increase in the calculated number of Band D properties between 2014/15 and 2015/16 the underlying level of Precept to be received by the PCC will increase by 1.6% between the 2 years, even if the PCC freezes precept in 2015/16.

3.23 This growth in Tax Base will provide a recurring benefit of over £800k more income from precept in comparison to the previously assumed financial plan.

3.24 Also in 2015/16, the significant collection surplus and the higher than initially forecast Council Tax freeze Grant will provide the PCC with a further £700k more funding than was expected within the Financial Plan that was presented in November 2014.

Option 2: Precept Rise of 1.99%

3.25 The Localism Act 2011 includes powers for council tax referendums. A referendum will take place if an authority, including a PCC, proposes a percentage increase in council tax that exceeds the level agreed. These referendums would be binding.

3.26 The provisional 2015/16 settlement issued by the Local Government Minister stated thatif a local authority, which includes PCC’s, seeks to raise their council tax by 2% or more in 2015/16 a local referendum must be held.

3.27 The section on precept freeze showed that freezing the precept in 2015/16 and 2016/17, and increasing by 1.99% per annum thereafter will result in more income from Precept than is currently assumed within the LTFP, as a result of the significant growth in Tax Base reported by the councils within North Yorkshire. It is however also important to understand the impact of increasing precept by 1.99% in 2015/16, in line with previous planning assumptions and referendum limits.

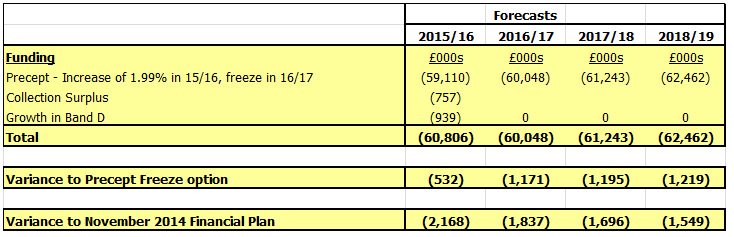

3.28 The table below sets out the additional funding, in comparison to the precept freeze option and the November planning assumptions, of the PCC choosing to increase precept by 1.99% in 2015/16 and in each year thereafter:

3.29 A precept increase in 2015/16 and would provide the PCC with significantly more income, in comparison to the precept freeze option, of over £500k in 2015/16 and around £1.2m recurring thereafter.

3.30 On top of this the PCC would still receive the additional income that results from the increase in the overall tax base. If these 2 elements are combined the PCC would have nearly £2.2m more ‘precept’ funding available in 2015/16 than the financial plan in November assumed and around £1.8m additional recurring funding in each year thereafter.

3.31 Net Budget Requirement

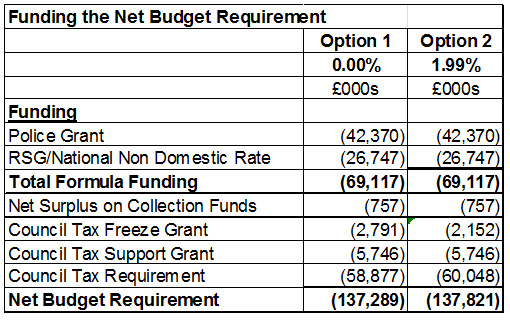

The Net Budget Requirement options are set out in the table below:

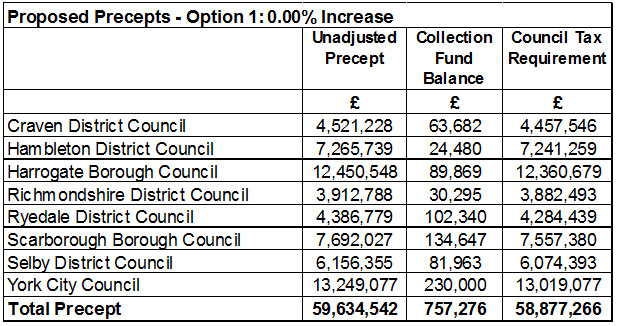

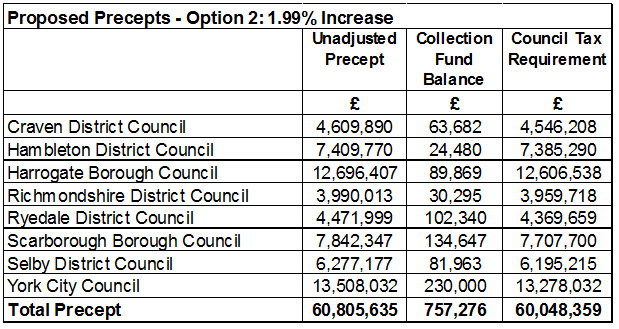

3.32 The final precept calculations are set out in the tables below based on the 2 options that the PCC has to consider:

3.33

3.34 The ‘basic amount’ of council tax is the rate for a Band D property. It is calculated by dividing the Council Tax Requirement by the total tax base i.e. £58,877,266 by 282,223 giving a council tax rate for Band D properties of £208.620.

3.35

3.36 The ‘basic amount’ of council tax is the rate for a Band D property. It is calculated by dividing the Council Tax Requirement by the total tax base i.e. £60,048,359 by 282,223, giving a council tax rate for Band D properties of £212.770.

3.37 The PCC is asked to agree that the basic amount of council tax proposed to the PCP (Band D equivalent) for 2015/16 be set at:

- £208.620 if Option 1 is chosen

- £212.770 if Option 2 is chosen

3.38 The proposed council tax rate for each property band is determined in accordance with the statutory proportions and is set out in the table below. It is advised that the tax rates should be calculated to more than 2 decimal places.

3.39 The Local Government Finance Act 1992 does not give authorities the power to delegate calculation of the tax payments or the ‘basic amount’ to officers or committees. These figures are consequently included in the recommendations in order that they may be agreed by the PCC with the advice of the PCCs Chief Finance Officer.

3.40 The impact of the options for increases in council tax is shown in the table below.

4 Consultation

4.1 To further inform the decision around the proposed precept for 2015/16 Consultation has been undertaken with the Public to ascertain their feedback and thoughts on this subject.

4.2 The public were asked ‘which of these statements best reflects your views on this proposal?’ There were three options:

- Freeze the local police precept and receive a grant of £640,000 from the Government to help offset the freeze for one year.

- Increase the precept by 1.99% in order to raise nearly £1.2 million for next year and subsequent years, but avoid a costly local referendum.

- Put the precept up by more than 1.99% which could raise more money, but will mean at least £700,000 spent on a referendum on the proposals

4.3 The results from this consultation, based on 1,527 responses were:

- 33% thought that precept should be Frozen and the Grant accepted from the Government.

- 64% thought that the precept should increase by 1.99%.

- 3% thought that the precept should be increased by more than 1.99%.

5 Implications

5.1 Finance

The financial implications from this report are covered in the body of the report based on which of the following options on Precept are chosen:

- Option 1 – A precept freeze

- Option 2 – A precept rise of 1.99%

While the paper includes a lot of technical information, the decision to propose a 1.99% increase in precept for 2015/16 versus a precept freeze will result in the following additional funding being available for Policing within North Yorkshire across the next 4 years:

The additional funding from a 1.99% increase, as opposed to a grant freeze, would result in a Band D property in North Yorkshire paying 8 pence per week more in 2015/16 than in 2014/15.

Overall Financial Context – Locally

While the decision on precept is a separate decision it is important that it is made in the overall context of the financial position of the organisation. With that in mind, attached as appendices to this report are the draft projected budgets should the PCC choose to propose:

- A Precept Freeze – Appendix B – Precept Freeze Option

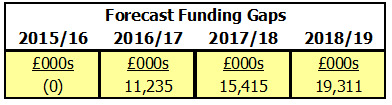

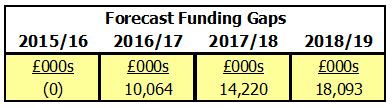

This shows a balanced budget for 2015/16 but significant savings required across the rest of the financial plan as per the table below:

- A 1.99% increase in Precept – Appendix C – Precept Increase Option

This shows a balanced budget for 2015/16 but significant, but lower than the precept freeze option, savings required across the rest of the financial plan as per the table below:

5.2 In addition to these projected revenue budgets also attached is the draft Capital Plan Summary, at Appendix D – Draft Capital Plan Summary, and an overview of the Reserves held by the PCC, and the forecast movements over the financial plan, at Appendix E – Overview of Reserves.

5.3 National Financial Context

The overall financial plans at a local level incorporate the latest financial information provided nationally. This is detailed below:

5.4 Government Funding for 2015/16

The Provisional Police Finance Settlement was announced in a written ministerial statement by the Minister for Policing, Criminal Justice and Victims on Wednesday 17 December 2014. This announcement covered the funding for 2015/16 only, as expected; with it widely anticipated that there will be a spending review following shortly after next year’s general election on 7 May 2015.

5.5 The announcement set out an overall £289m, or 3.4%, cash reduction in the overall Police Revenue Funding, as set out in the table below.

| Police Revenue Funding | 2014/15 | 2015/16 | Change |

| £m | £m | % | |

| Funding to PCCs | |||

| Home Office Police Grant | 4,583.3 | 4,309.2 | -6.0% |

| Formula Funding (ex-DCLG) | 2,923.5 | 2,818.3 | -3.6% |

| Welsh Government | 140.0 | 135.0 | -3.6% |

| Welsh Top-Up | 13.1 | 12.5 | -4.7% |

| Counter-Terrorism Specific Grant | 564.0 | 564.0 | – |

| Council Tax Freezes for London | 23.6 | 30.4 | 28.9% |

| 2011/12 Council Tax Freeze | 58.8 | 58.8 | – |

| 2013/14 Council Tax Freeze | 7.3 | 7.3 | – |

| 2014/15 Council Tax Freeze | 2.7 | 2.7 | – |

| Sub-Total | 8,313.7 | 7,938.3 | -4.5% |

| Other Areas Funded | |||

| National Police Coordination Centre | 2.3 | – | – |

| PFI | 72.8 | 72.8 | – |

| Ordnance Survey | 1.7 | 1.7 | – |

| Contingency | 5.9 | – | |

| IPCC | 18.0 | 30.0 | 66.7% |

| Innovation Fund | 50.0 | 70.0 | 40.0% |

| College of Policing | 2.8 | 4.6 | 64.3% |

| City of London | 2.5 | 2.8 | 14.3% |

| HMIC | 9.4 | 9.4 | – |

| Police Knowledge Fund | 5.0 | – | |

| Major Programmes | 40.0 | – | |

| Police Special Grant | 15.0 | – | |

| Sub-Total | 165.4 | 251.4 | 52.0% |

| Total Government Funding | 8,479.1 | 8,189.6 | -3.4% |

5.6 Despite the various funding streams experiencing various percentages of reductions/increases each PCC has seen a 5.1% cash reduction in the ‘Core Central Government Funding’ which is termed Police Grant and Formula Funding in the above table.

5.7 For North Yorkshire this has meant a cash reduction of £3,722k in Government Grant. This was in line with the forecasted 5.0% reduction that was previously included in the MTFP and as such there has been no requirement for any significant amendments to the financial plans.

5.8 As can be seen from the table at 5.5 significant ‘top slicing’ has once again taken place in 2015/16. Had the £180m or so of ‘top-slicing’ simply been allocated to North Yorkshire in the same proportions as the Core Government Funding then the PCC would have received an additional £1.7m in 2015/16 to support local policing and crime activities.

5.9 Government Funding for 2016/17 and beyond

There is still currently no clear indication of what will happen to the levels of Government Funding for 2016/17 and beyond. As mentioned above there is expected to be a spending review following shortly after next year’s general election however it remains unlikely that this would deliver detailed allocations to PCC’s. What continues to be expected however is that reductions in government funding will not end in 2015/16, it might be proposed that the cuts are paused however over the longer term the trend in funding is likely to continue to be downwards and therefore it is prudent to plan for further cuts.

It is however very difficult to project what the level of reductions will be going forward. For planning and consistency purposes it has therefore been assumed that Government Grants will reduce by 2.5% per annum in each year thereafter. This assumption will be considered further during 2015/16 and when the next spending review actually takes place

5.10 Risk

The requirements on the PCC to propose and consult with the PCP on their proposals for Precept are set out in legislation and covered in this report. Failure to start the consultation process with the PCP before the end of January 2015 and to conclude this process, including setting a precept before 1st March 2015, would result in an illegal budget.

- Conclusion

6.1 The PCC has been presented with 2 options in relation to Precept for 2015/2016. These options seek to provide the PCC with the realistic choices that they have in relation to Precept and the impact of those choices. The challenge that the PCC faces when considering the Precept for 2015/16 is in getting the balance right between the following, sometimes competing challenges:

- Maintaining/Improving Service Levels

- Improving Performance

- Savings and Efficiencies

- Prudent Reserves over the MTFP period

- Impact on Council Tax Payers

- National guidelines on Precept increases

6.2 Once the PCC has elected one of the 2 choices outlined within this paper, or if they prefer an alternative option can be developed, then this will be proposed to the Police and Crime Panel by the 31st January 2015 to ensure that the PCC is in line with the legislation and the legislative timeframes.

- Consultations carried out

The PCC has consulted on the Precept with the public, the results of which are outlined within this report. Detailed information was also provided to the Police and Crime Panel at a meeting in January 2015.

- Financial Implications/Value for money

PCC Chief Finance Officer Comments:

The report reflects the comments, information and advice of the PCC’s Chief Finance Officer.

- Legal Implications

The requirements on the PCC to propose and consult with the PCP on their proposals for Precept are set out in legislation and covered in this Decision Notice. Failure to start the consultation process with the PCP before the end of January 2015 and to conclude this process, including setting a precept before 1st March 2015, would result in an illegal budget.

10. Human Resource Implications

Whilst no direct people related issues are evident in this proposal it is noted that as the majority of the organisation’s budget is invested in people resources any decision made may consequently have an impact on the resources we are able to employ in the future.

Public Access to information

The Police and Crime Commissioner wishes to be as open and transparent as possible about the decisions he/she takes or are taken in his/her name. All decisions taken by the Commissioner will be subject to the Freedom of Information Act 2000 (FOIA).

As a general principle, the Commissioner expects to be able to publish all decisions taken and all matters taken into account and all advice received when reaching the decision. Part 1 of this Notice will detail all information which the Commissioner will disclose into the public domain. The decision and information in Part 1 will be made available on the NYPCC web site within 2 working days of approval.

Only where material is properly classified as restricted under the GPMS or if that material falls within the description at 2(2) of The Elected Local Policing Bodies (Specified Information) Order 2011 will the Commissioner not disclose decisions and/or information provided to enable that decision to be made. In these instances, Part 2 of the Form will be used to detail those matters considered to be restricted. Information in Part 2 will not be published.

Part two

Is there a Part 2 to this Notice – NO (please delete as appropriate)

If Yes, what is the reason for restriction –

Originating Officer Declaration

Author name: Michael Porter

Collar number: 4317

| Chief OfficerThe PCC’s CFO has reviewed the request and is satisfied that it is correct and consistent with the NYPCC’s plans and priorities. | Michael Porter 004317 | 28.01.2015 |

| Legal AdviceLegal advice has been sought on this proposal and is considered not to expose the PCC to risk of legal challenge or such risk is outlined in Part 1 or Part 2 of this Notice. | Jane Wintermeyer003840 | 29.01.15 |

| Financial AdviceThe PCC CFO has been consulted on this proposal, for which budgetary provision already exists or is to be made in accordance with Part 1 or Part 2 of this Notice. | Michael Porter 004317 | 28.01.2015 |

| Equalities AdviceEither there is considered to be minimal impact or the impact is outlined in Part1 or Part2 of this Notice. Author to complete as Equalities matters are mainstreamed within departments. | Michael Porter 004317 | 28.01.2015 |

| HR AdviceHR advice has been sought in relation to any people related matters | Rosemarie Holmes4647 | 29. 01.15 |

| I confirm that all the above advice has been sought and received and I am satisfied that this is an appropriate request to be submitted for a decision |

Appendices

- Appendix A – Precept Options

- Appendix B – Precept Freeze Option

- Appendix C – Precept Increase Option

- Appendix D – Draft Capital Plan Summary

- Appendix E – Overview of Reserves

You may also be interested in:

- Download 27/2015 Notification of the Commissioner’s Precept Proposal for 2015/16 to the North Yorkshire Police and Crime Panel in PDF format

- Report on Police Precept Consultation January 2015

- Published on