08/2016: Prudential Indicators and Annual Investment Strategy 2016/17 – 25 February 2016

Executive Summary and Recommendation:

This is a Decision Notice outlining the Commissioner’s Prudential Indicators and Annual Investment Strategy for 2016/17.

To comply with the CIPFA Prudential Code of Practice, the Commissioner is required to set a range of Prudential Indicators for the financial year 2016/17. The Prudential Code requires the Commissioner to self-regulate the affordability, prudence and sustainability of their capital expenditure and borrowing plans, by setting estimates and limits, and by publishing actuals, for a range of Prudential Indicators. The code states that Prudential Indicators for Treasury Management should be considered together with the Annual Investment Strategy for 2016/17. The content of this decision note addresses these requirements.

It is recommended, by the Commissioners Chief Finance Officer, that the Commissioner:

- Approves the Prudential Indicators set out in Section 2 of this report.

- Approves the Annual Investment Strategy set out in Section 3 of this report.

Decision

Police and Crime Commissioner decision: Approved

Signature:

Date: 25 February 2016

Title: Police and Crime Commissioner

1. Introduction and Background

Prudential Indicators

The Prudential Code requires authorities (including the PCC) to self-regulate the affordability, prudence and sustainability of their capital expenditure and borrowing plans, by setting estimates and limits, and by publishing actuals, for a range of Prudential Indicators. It also requires them to ensure their Treasury Management Practices are in accordance with good practice.

The Code imposes on authorities clear governance procedures for setting and revising of Prudential Indicators, and describes the matters to which an authority will have regard when doing so. This is designed to deliver accountability in taking capital financing, borrowing and Treasury Management decisions. A fundamental provision of the Prudential Code is that over the medium term net borrowing will only be for a capital purpose.

Under the Code, individual authorities are responsible for deciding the level of their affordable borrowing, having regard to the code. Under the code the PCC is required to set a range of Prudential Indicators for the financial year 2016/17.

The code states that Prudential Indicators for Treasury Management should be considered together with the Annual Investment Strategy.

2. Prudential Indicators

Affordability Indicators

The following indicators are required to assess the affordability of the capital investment plans. They provide an indication of the impact of the capital investment plans on the Commissioner’s overall finances.

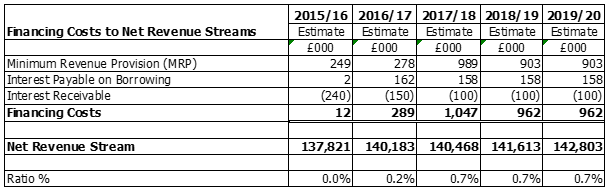

Ratio of Financing Costs to Net Budget Requirement

This indicator identifies the trend in the cost of capital against the net budgetary requirement. In effect it is looking at how much of the revenue budget needs to be set aside for the funding of capital decisions and how sustainable this is going forward.

While the percentage of the net revenue stream needed to be set aside to fund financing costs is expected to increase during 2017/18 it is still projected to remain below 1% of the overall budget and therefore shouldn’t provide any long terms problems in terms of affordability and sustainability.

It is worth bearing in mind that a significant proportion of the Capital Expenditure is funded from revenue contributions to Capital. If future budgets can’t accommodate these continued contributions, which are expected to be around £3.5m per annum through to 2019/20, then this would have a significant impact on either the ability of the organisation to continue with the investment plans and/or it would have to significantly increase planned levels of borrowing. This in turn would impact on this calculation and would ultimately increase the amount of the revenue budget that would need to be set aside to fund financing costs.

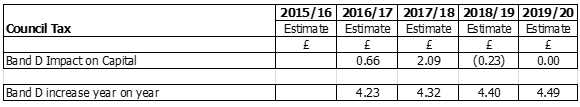

Incremental Impact of Capital Investment Decisions on Band D Council Tax

This indicator shows the incremental impact of the additional capital expenditure that is planned in the current programme on the Band D council tax.

At this time the projected impact of the additional capital expenditure in terms of financing costs show no real areas of concern. It is worth keeping in mind previous comments however in terms of current levels of contributions from revenue into the capital programme and also looking at 2017/18 where ‘in effect’ nearly 50% of the projected increase in the Band D level of precept for that year will be needed to fund the projected increased finance costs. At this is forecast to be a ‘one-off’ then it is not a cause for concern however if this was a recurring position the organisation would need to consider the impact of its investment decisions.

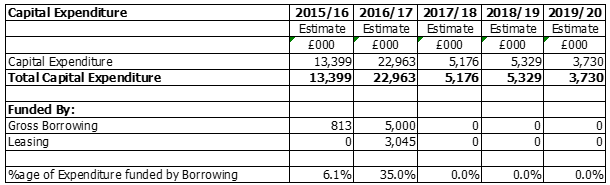

Prudence

The ‘prudence’ indicator generally looks at the level of borrowing needed to maintain the current plans of the organisation.

Based on the current plans, the forecast significant level of borrowing and leasing required in 2016/17 shouldn’t provide too much concern and it is all affordable within current plans.

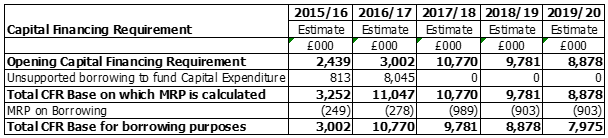

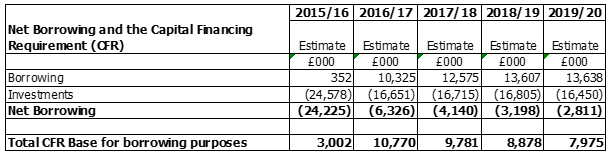

The PCC’s Borrowing Need (The Capital Financing Requirement)

The Capital Financing Requirement (CFR) measures the PCC’s underlying need to borrow for Capital purposes and ensures that borrowing is only undertaken to fund capital assets and not support revenue expenditure.

The Borrowing and leasing requirement including within the plans increases the CFR. The PCC is required to make a statutory charge to revenue for the repayment of debt (the Minimum Revenue Provision) and this reduces the CFR.

Limits to Borrowing Activity

Within the Prudential indicators there are a number of indicators to ensure that the PCC operates its activities within well-defined limits.

For the first of these the PCC needs to ensure that its total borrowing net of any investments does not, except in the short term, exceed the total of the CFR in the preceding year plus the estimates of any additional CFR for 2016/17 and the following two financial years. This allows some flexibility for limited early borrowing for future years, to take advantage of market opportunities and to build in budget uncertainty.

The CFR as set out above across all 5 years is not forecast to be in excess of the ‘net borrowing’ of the organisation and therefore the PCC can be assured that any borrowing that is forecast to be taken out over the coming years would not be to support revenue expenditure.

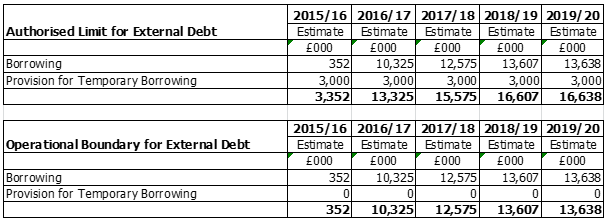

A further two prudential indicators control or anticipate the overall level of borrowing. These are:

- The Authorised Limit which represents the limit beyond which borrowing is prohibited and needs to be set and revised by the PCC, borrowing beyond this limit would be ultra vires.

- The Operational Boundary which is based on the probable external debt during the course of the year. It can include scope for borrowing for revenue purposes that may be required in the short term during the year, if for instance a large grant payment was delayed. However at this point no allowance for this has been made.

Treasury Management Indicators

The purpose of these is to contain the activity of the Treasury function within certain limits, thereby reducing the risk or likelihood of an adverse movement in interest rates or borrowing decisions impacting negatively on the PCC’s overall financial position.

Upper Limits on Borrowing

This indicator identifies a maximum level of borrowing that can be made at Fixed and Variable interest rates.

This means that 50%-100% of our borrowing will be at rates fixed until the loan is repayable, while no more than 50% will be at variable rates so liable to change at short notice.

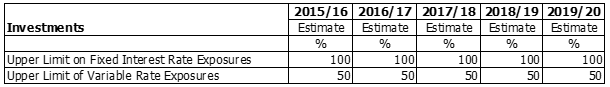

Upper Limits on Investments

This indicator identifies a maximum level of investments that can be made at Fixed and Variable interest rates.

This means 50%-100% of our investments will be at rates fixed until the investment matures, while no more than 50% will be at variable rates so liable to change at short notice.

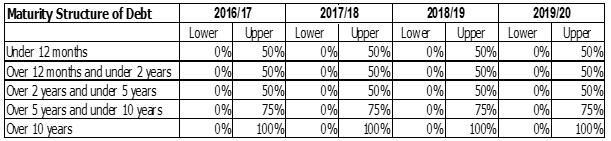

Maturity Structure of Debt

These gross limits are set to reduce the PCC’s exposure to large fixed rate sums falling due for re-financing within a short timeframe. Upper and lower limits are required which the PCC is asked to approve.

As the PCC moves into a position of having external debt then in becomes important to consider the timeframes under which these loans are taken out, when they will be re-paid and how this aligns with other debt repayments.

Upper Limit for Sums Invested for a Period of over 364 days

This indicator sets a limit on the level of investments that can be made for more than 364 days. The PCC does not provide approval to invest beyond a 1 year period and at this stage it is not currently proposed to change this proposal.

Annual Investment Strategy

The proposed Annual Investment Strategy for 2016/2017 is set out in section 3 of this report.

Returns on Investments

While returns on investments are of secondary importance to the security of the sums invested, it is still important to consider the potential impact of approving the Investment Strategy put forward. The limited number of counterparties on our list potentially restricts the returns, in the form of interest receivable, which the PCC can make.

Given the current low level of interest rates, the Bank of England Base rate is currently 0.5% and has been for almost 7 years, the impact will be relatively small. The budget set for interest receivable in 2016/17 is £150k.

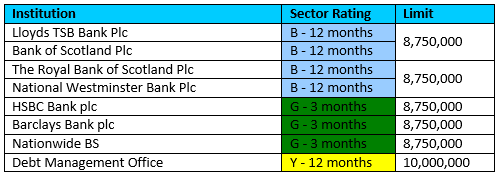

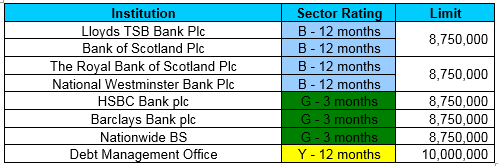

Counterparty Limits

As per the strategy in Section 3, limits for specified counterparties are:

3. Annual Investment Strategy

Annual Investment Strategy

The Commissioner will have regard to the CLG’s Guidance on Local Government Investments (“the Guidance”) and the 2011 revised CIPFA Treasury Management in Public Services Code of Practice and Cross Sectoral Guidance Notes (“the CIPFA TM Code”). The Commissioner’s investment priorities are:

- the security of capital; and

- the liquidity of its investments.

The Commissioner will also aim to achieve the optimum return on investments commensurate with proper levels of security and liquidity. The Commissioner’s risk appetite is low in order to give priority to security of investments.

The borrowing of monies purely to invest or on‑lend and make a return is unlawful and the Commissioner will not engage in such activity.

Investment instruments are identified as either ‘Specified’ or ‘Non-Specified’ Investments. The Commissioner’s available instruments are listed in paragraph below. Counterparty limits will be as set through the Treasury Management Practices.

It is proposed that the Annual Investment Strategy for 2016/17 is based solely upon the use of “specified” investments listed below, with all such investments being sterling denominated, with a UK owned bank or building society, with maturities up to a maximum of 364 days (<12 months):

- Debt Management Agency Deposit Facility

- Term Deposits – UK Government

- Term Deposits – other local authorities

- Term Deposits – banks and building societies

- Money market funds

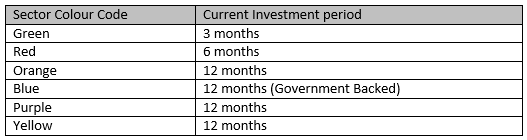

A summary of the current investment periods are outlined below with the main emphasis being on increasing the liquidity of funds by reducing the length of time any one investment should be held with a counterparty:

The Treasury Management Function takes cognisance of latest market information produced by the treasury advisors (Sector) to support decisions regarding maturity periods and counterparty limits.

The current limits are shown below:

4. Contribution to Police and Crime Plan Priorities

The recommendations in this Decision Notice are offered on the basis that they support the finances of the organisation, ensuring that legislative requirements are met in relation to prudently providing for the costs of borrowing, and therefore underpin all of the Police and Crime Plan priorities.

5. Consultations Carried Out

The below table should include who has been consulted and their feedback. Not all departments will need to be consulted with on every proposal, however, they should all be considered:

| Name | Department | Comments |

| Will Naylor | Office of the PCC | No |

| Jane Palmer | Financial Services | No |

| Lisa Winward | Local Policing | No |

| Lisa Winward | Beyond Local Policing | No |

| Leanne Consett | Human Resources | No |

| Jane Wintermeyer | Joint Corporate Legal Services | No |

| Louise Wood | Corporate Communications | No |

| Jonathan Garrett | Property and Facilities | No |

| Sudeep Chatterjee | Information and Communications Technology | No |

| Bob Brigginshaw | Transport | No |

| Jenni Newberry | Joint Corporate Commissioning and Partnership Services | No |

| Nicola Johnston | Procurement | No |

| Maria Earles | Organisation and Development | No |

| Sarah Wintringham | Information Management | No |

5. Compliance Checks

Financial Implications/Value for money:

This Decision Note has been compiled by the Chief Finance Officer for the PCC and therefore the financial implications are outlined within the report and reflect the comments, advice and recommendations of the post holder.

Legal Implications:

Having read this report and having considered such information as has been provided at the time of being asked to express this view, the Acting Force Solicitor and Head of Legal Services is satisfied that this report does not ask the PCC for North Yorkshire to make a decision which would (or would be likely to) give rise to a contravention of the law.

Human Resources Implications:

The contents of this decision acknowledged as a requirement of The CIPFA Prudential Code of Practice. No overt HR implications are noted as workforce planning projections are already in place for 2016/17.

Public Access to information

As a general principle, the Commissioner expects to be able to publish all decisions taken and all matters taken into account when reaching the decision. This Notice will detail all information which the Commissioner will disclose into the public domain. The decision and information will be made available on the Commissioner’s website.

Only where material is properly classified as Restricted under the Government Protective Marking Scheme or if that material falls within the description at 2(2) of The Elected Local Policing Bodies (Specified Information) Order 2011 will the Commissioner not disclose decisions and/or information provided to enable that decision to be made. In these instances, Part 2 will be used to detail those matters considered to be restricted. Information in Part 2 will not be published.

All decisions taken by the Commissioner will be subject to the Freedom of Information Act 2000 (FOIA).

Part 2

Is there a Part 2 to this Notice – NO

Report Information

Author(s) and Executive Group Sponsor: Michael Porter, PCC Chief Finance Officer

Date created: 15 February 2016

Background documents:

I confirm that all the above advice has been sought and received against this and any associated Part 2 information and I am satisfied that this is an appropriate request to be submitted for a decision

Signature: Michael Porter

Date: 25 February 2016

Download

- Published on