04/2017: Medium Term Financial Plan 2017/18 to 2020/21 and Capital Plans 2017/18 to 2020/21

On this page

- Executive Summary and Recommendation:

- Decision

- 1. Introduction and Background

- 2. Recommendations

- 3. Planning and Funding Assumptions

- 4. Affordability Programme

- 5. Overall Financial Summary

- 6. Capital Financing and Expenditure

- 7. Reserves and Risks

- 8. Consultations Carried Out

- 9. Compliance Checks

- Part two

- Report Information

- Appendix A

Executive Summary and Recommendation:

This is a Decision Notice outlining the Commissioner’s Budget and Capital Plans for 2017/18 and the Medium Term Financial Plans to 2020/21.

There is a legal requirement for the PCC to set a budget prior to the 1st March each year for the following financial year. Approving this Decision Notice will ensure that the PCC’s obligations in this area are met for 2017/18.

The Revenue Budget for 2017/18 is based on the approved 1.99% increase in precept for 2017/18 and sets out how the £154,684k of revenue funding, to be received by the PCC in 2017/18, will be spent. The decision notice also sets out a capital and revenue development programme of just over £24m for 2017/18 and provides details of how this will be spent.

It is recommended, by the Commissioners Chief Finance Officer, that the Commissioner approves the Budget and Capital Plans for 2017/18 as set out in this Decision Notice along with the Medium Term Financial Plans to 2020/21. In approving this decision the Commissioner is agreeing to the allocation of resources set out within this decision and the associated appendices, and also the detailed recommendations in section 2 of this decision notice.

Decision

Police and Crime Commissioner decision: Approved

Signature:

Date: 28 February 2017

Title: Police and Crime Commissioner

1. Introduction and Background

1.1 Purpose of the Report

This report asks the PCC to agree the Budget proposals for 2017/18 and the Medium Term Financial Plan (MTFP) for 2017/18 – 2020/21 in line with the legal requirement to set a budget prior to the 1st March each year for the following financial year. It also asks the PCC to agree the funding for the Capital and Revenue Development Programme for 2017/18 and the indicative allocations for the period 2018/19 to 2020/21.

2. Recommendations

2.1 The PCC is requested to approve the allocation of the £154,684k of revenue funding, that is forecast to be received by the PCC in 2017/18, in the following areas:

- £911k to run the Office of the PCC (see Appendix A)

- £3,641k for Commissioned Services

- £25,492k for Corporate Services

- £126,250k to the Police Force

- £3,885k to the Capital Programme

- £5,499k from Reserves

2.2 The PCC is asked to note that the 2017/18 budget is based on the approved 1.99% increase in precept for 2017/18.

2.3 The PCC is asked to take cognisance of the Robustness of Estimates and Adequacy of Financial Reserves Report of the PCCs CFO that was discussed prior to this report.

2.4 The PCC is asked to agree that quarterly updates to the MTFP forecast will be brought to the PCC in 2017/18 to provide an update on the progress to deliver against this plan and to keep the PCC updated on changes to the plans.

2.5 The PCC is asked to agree that quarterly updates on the 2017/18 budget will be brought to the PCC in 2017/18 to provide updates on performance against the 2017/18 budget.

2.6 In order to implement the Capital and Revenue Development Programme (CDRP) and facilitate incurring and management of the expenditure, the following approvals are requested:

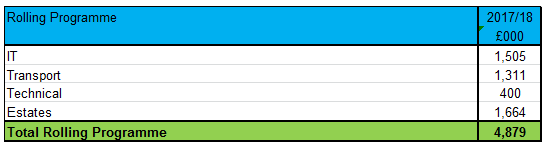

(a) Approval of the 2017/18 Rolling Programme budgets, totalling £4,879k as set out below:

(b) Approval of the small items fund of £250k for 2017/18, to be managed as set out in the Financial Regulations by the Chief Constables Chief Finance Officer.

(c) Delegation to the Commissioners Chief Finance Officer to approve, where needed and appropriate, for the carry forward of any slippage from the approved 2016/17 CRDP into 2017/18.

3. Planning and Funding Assumptions

Overall Financial Context

3.1 National Budget

Since the 2016/17 Budget was set there have been some significant changes to the political landscape and also a number of key financial announcements. These include the following:

- There has been a National Budget; this took place on the 16th March 2016.

- On the 23rd June the UK voted to leave the European Union

- David Cameron resigned as Prime Minister

- Theresa May subsequently became leader of the Conservative Party and on the 13th July 2016 she became Prime Minister.

- The Autumn Statement took place on the 23rd November 2016.

- The Provisional and Final ‘Police’ Settlement for 2017/18

The key areas in terms of financial planning and budgeting have been incorporated into these updated financial plans.

3.2 Provisional 2017/18 Police Funding Settlement

The Provisional 2017-18 Police Finance Settlement was announced in a written ministerial statement by the Minister of State for Policing and Fire Services, Brandon Lewis, on Thursday 15th December. The Final Settlement, on the 1st February 2017, confirmed the resource funding figures published in the provisional settlement.

3.3 Headlines

The statement announced that ‘Following the principles set out on the 4 February 2016 when publishing the final police funding settlement for 2016/17 direct resource funding for each PCC, including precept, will be protected at flat cash levels compared to 2015/16, assuming that precept income is increased to the maximum amount available in both 2016/17 and 2017/18. No PCC who chooses to maximise precept in both years will face a reduction in cash funding next year compared to 2015/16. We have updated our precept forecasts for 2017/18 since February to reflect actual tax base increases in 2016/17’

3.4 Taking the actual tax base increases across the country into account before then adjusting the levels of Grant to be given to each PCC is a change in the application of the ‘flat cash’ policy in comparison to the previous year which has led to a larger reduction in grant than forecast and also the inclusion of larger reductions in grant forecast for the next 2 years.

3.5 The reduction applied to grant funding in 2017/18 is 1.4% in cash terms, which equates to a cash reduction of £961k for North Yorkshire.

3.6 As expected, this provisional settlement covers just one year and confirms the previously-announced council tax flexibility whereby the 10 Policing Areas with the lowest Band D precept level can increase their Band D precept by £5. North Yorkshire is not one of these areas.

3.7 Top-slices/Reallocations totalling £812m have been announced for 2017/18. The areas this funding will now be spent on is as follows:

- PFI – £73m

- Police Technology Programme – £417m

- Arm’s Length Bodies – £54m

- Strengthening the response to organised crime – £28m

- Police Transformation Fund – £175m

- Special Grant – £50m

- Pre-Charge Bail – £15m

3.8 Legacy Council Tax funding is still separately identifiable and has not changed from 2016/17. The statement confirmed that there would be no council tax freeze scheme in 2017/18.

3.9 Police Capital Grant that is to be allocated to PCC’s has reduced by a further £8.2m, or just over 15%. This will have the impact of reducing the Capital Grant payable to North Yorkshire by £77k.

3.10 Counter Terrorism

In the statement the Minister announced that he ‘will continue to allocate specific funding for counter-terrorism policing over the course of the Spending Review period to ensure that the police have the capabilities to deal with the terrorist threats that we face, in addition to the funding set out in this settlement. Funding for counter terrorism policing is protected. The indicative Spending Review profile for counter terrorism police funding in 2017/18 is £670m; this figure will be confirmed separately. In addition a further £32m will be provided for armed policing from the Police Transformation Fund in 2017/18.’

3.11 Individual allocations have not yet been announced and are expected to be notified during February however for security reasons these allocations will not be available in the public domain.

3.12 Ministry of Justice (MoJ) Funding

The Victim’s Funding comes from the MoJ. The recently announced allocation to PCC’s has provided £883k for Victims Services and a further £66k for Child Sexual Abuse services. This is £4k less than last year as this funding is allocated based on population, which has grown quicker in other parts of the country than in North Yorkshire.

3.13 Funding Formula

The Government has been clear that existing arrangements for distributing core grant funding to police force areas in England and Wales need to be reformed. These arrangements are complex, outdated and reflect a picture of policing risk and demand which has moved on and – fundamentally – are born out of the interaction between separate Home Office and DCLG funding formulae which can no longer be updated.

3.14 The Minister of State for Policing and the Fire Service wrote to all Police and Crime Commissioners on 14 September setting out plans for continuing work to review these arrangements, focussed on developing a new Police Core Grant Distribution Formula. The first stage of this work will be a period of detailed engagement with the policing sector and relevant experts. Any final decisions on implementation of a new formula will follow a period of public consultation.

3.15 The Review will take place between October 2016 and February 2017 and comprise a period of detailed engagement with the policing sector and relevant independent experts, which will make recommendations to the Home Office on a new formula for distributing Police Core Grant funding to PCCs (and their London equivalents) in England and Wales.

3.16 Specifically, the Review will have the following objectives:

- To agree a set of core principles that a future formula should be based on (using fairness; transparency; stability; alignment with expected relative risk and demands; and, appropriately incentivising efficiency and effectiveness as the starting point, and the balance that a new formula should strike between them;

- To develop proposals on a new police core grant distribution formula which aligns with these principles and takes account of the significant drivers of risk and demands for policing services;

- To consider whether and how to take into account regional cost variations in a new formula;

- To consider whether and how a new formula should take into account forces’ local council tax base;

- To advise the Home Office on the options for transition to a new formula.

3.17 The formula will be based on 5 key principles:

- Stability

- Fairness

- Transparency

- Incentivising efficiency & effectiveness, and

- Alignment with risk.

3.18 These are complemented by 6 policy objectives:

- Encourages efficiency

- Recognises local circumstances including ability to raise council tax

- Avoids prolonged transition

- Stable and predictable

- Enables transformation and future proofing, and

- Encourages upstream crime prevention.

3.19 There are 3 building blocks:

- Relative needs and demands (likely to be based around population, socio-economic factors, geography & environmental)

- Relative costs and needs

- Variation in local tax raising powers

3.20 While this is a new process, with a new minister, many of the key principles, objectives and building blocks are not that dissimilar to those previously looked at during the last Funding Formula Review. That review, prior to the discovery of an error in the formula by Devon and Cornwall, was forecast to result in a reduction in Funding for North Yorkshire of around £3.5m to £4.0m per annum.

3.21 The results from this original formula, across all Policing areas, was presumably acceptable to the Home Office and therefore it is likely to be prudent to plan for a formula that results in a similar impact on the Government Grant allocations for North Yorkshire.

3.22 The impact of any new Formula is likely to take place from 1st April 2018, with any changes phased. Based on these assumptions and for planning purposes this MTFP assumes that the Funding Formula will reduce the funding available to the PCC, in the form of Government Grant, by £1m per annum from 2018/19. In cumulative terms this has reduced the previous Government Grant forecasts by:

- 2018/19 – £1m

- 2019/20 – £2m

- 2020/21 – £3m

3.22 As more information becomes available these assumptions will be reviewed.

3.23 Until there is clarity in relation to this area it remains a significant risk to the financial plans of the organisation and one that will need to be closely monitored going forward.

3.24 It is important to note that in the 7 years to 2017/18 Government Grants have reduced by nearly £20m (or 22%) in cash terms and in real terms by nearly £30m (or 33%)

3.25 MTFP Assumptions

When the 2016/17 budget was set in February 2016 the forecasts were underpinned by the following assumptions:

- Pay Awards: 1% increase per annum

- Precept: Increases of 1.99% per annum

- Tax Base increases of 0.5% per annum

- Collection Surplus of £150k per annum

- Grant Reductions of -0.6% per annum

- Impact of Funding Formula Review – Nil

- Inflation: 1.25% for most areas, 2.5% for Utilities, Petrol and Rates

3.26 In line with good planning our assumptions remain under review and are updated with the best information available, most assumptions have not changed significantly and the MTFP for 2017/18 and beyond assume the following:

- Pay Awards: 1% increase p.a until 2019/20

- Precept: Increases of 1.99% per annum

- Tax Base increases 1.0% per annum, Collection Surplus £300k p.a

- Grant Reductions: -1.4%, until 2019/20

- Impact of Funding Formula review – as per para. 3.22

- Inflation: 1.25% for most areas, 2.5% for Utilities, Petrol and Rates

3.35 Precept

Over 45% of the Net Budget Requirement within North Yorkshire is now funded by the local precept and therefore this will provide more of a cushion to cuts in government grants, including any reductions from a revised Funding Formula, than in most Police Force areas. This is projected to increase to nearly 50% of the Net Budget Requirement by the end of the planning period covered by this MTFP.

3.36 The assumption throughout this plan, for planning purposes, is that the ‘Police’ element of each Council Tax Band will continue to increase at a rate of 1.99% per annum, although this will be subject to an annual decision.

3.37 The Government have informed PCC’s that ‘You should plan on the basis that the overall referendum limit for police precept will be maintained at 2% over the Spending review period for Police and Crime Commissioners in England.’ Therefore the risk in relation to this assumption going forward is manageable locally and subject to local decision and consultation annually.

3.38 There have therefore been no changes to the assumptions within this area since the February MTFP was approved.

3.39 Number of Band D Equivalent Properties and Collection Surpluses

Over the last 4 years there have been significant increases in both the number of calculated Band D properties within North Yorkshire and also significant Collection Surpluses to which the PCC has benefited from.

3.40 In line with Government projections and based on historic trends the financial plans previously included a 0.5% increase in the underlying tax base on an annual basis and a £150k per annum collection surplus.

3.41 However the growth in tax base has continued into 2017/18 and is forecast, by the local councils to continue to increase at around 1% per annum in future years. Tax base growth of 1% per annum, from 2018/19 onwards, has therefore been factored into this plan.

3.42 The combined Collection Surplus payable to the PCC in 2017/18 is £993k which is well in excess of the £150k included within the previous MTFP. In the 6 years prior to the Localisation of Council Tax benefits, the overall surplus on the collections funds of the 8 Councils, averaged just under £140k per annum. In the following 4 years the collection surpluses have been as follows:

- 2014/15 – £385k

- 2015/16 – £757k

- 2016/17 – £971k

- 2017/18 – £993k

3.43 It is therefore reasonable to assume that the trend of higher collection surpluses continues across the life of the MTFP and therefore an annual collection surplus of £300k has now been included.

3.44 These changes will be kept under review as part of the MTFP planning process into the following financial years and revised as necessary in line with the rest of the plan.

3.45 Specific Grants, Other Income and Partnership Fees and Charges

These sources of income and funding are forecast to provide between £12.3m and £13.0m across the life of the plan.

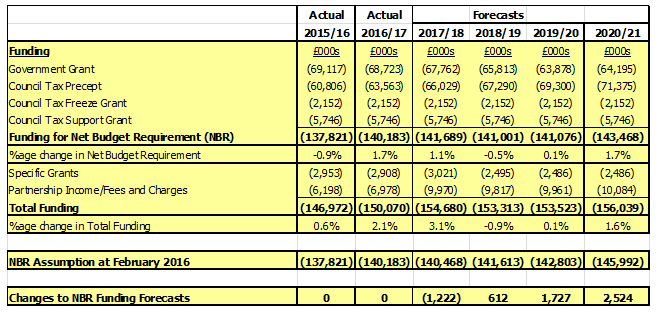

3.47 Based on these revised assumptions and the information received and forecast around other areas of funding then the entire funding expected to be available for the next 4 years, in comparison to both 2015/16 and 2016/17, is as follows:

3.48 As can be seen from the above the Net Budget Requirement (This is the amount the PCC estimates as its planned spending, after deducting any income it expects to raise from fees and charges, specific grants from the Government and any movements on reserves) is expected to increase in 2017/18, by £1.5m (or 1.1 %,) based on the precept increase of 1.99%, from 2016/17.

3.49 While this is £1.2m more than the organisation was planning for 2017/18, as at February 2016, it is worth noting that the following unavoidable additional costs to the organisation in 2017/18, in comparison to 2016/17, absorb all of this increase:

- National Pay Award agreements – £1.0m

- Contribution to Apprentice Levy – £0.4m

3.50 It is also important to look beyond 2017/18, when the potential impact of a revised funding formula may impact on the funding available for Policing and Crime within North Yorkshire.

3.51 Therefore the strong growth in the underlying Tax Base and the significant, but non-recurring Collection Surplus, have absorbed the larger than expected reductions in government grant for 2017/18.

3.52 As mentioned earlier the government has stated that ‘No PCC who chooses to maximise precept in both years will face a reduction in cash funding next year compared to 2015/16.’ This refers to the amount of cash received for the Net Budget Requirement (excluding the impact of collection Surpluses). Between 2015/16 and 2017/18 this level will have increased by £3.6m or nearly 2.7% for North Yorkshire, this is in the top 3 funding settlements for Police Force Areas over this time period.

4. Affordability Programme

4.1 The Affordability Programme was established during 2015/16 to look at how we can shape the organisation and the operations to deliver the right service to the public of North Yorkshire within the budgetary constraints.

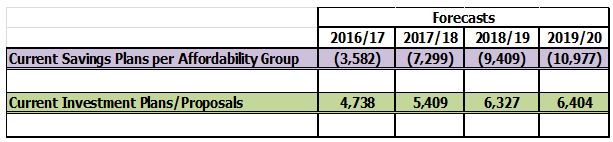

4.2 Significant savings and investment plans, which were detailed in setting the 2016/17 Budget, resulted from this work and were factored into the MTFP in line with the totals indicated below:

4.3 The work to deliver both the savings and investment plans have continued throughout 2016/17 and as at this point it is expected that the following savings and investments will need to be delivered across the life of this MTFP to deliver those plans from a financial perspective.

4.4 The delivery of this programme will continue to be monitored through the Affordability Group, along with new areas for delivery of savings which can then aid in balancing the plan in future years and also enable continued investment in priority areas.

4.5 The progress of this work will be tracked during the year as part of the Budget Monitoring process and included within future MTFP updates. It is worth noting that the budget to be set for 2017/18 includes an assumption that nearly £2.4m of savings will be delivered during the year. It is vital that these are delivered otherwise an over spend is likely to develop during the year with the potential for this to impact on the planned investments as well as the future financial plans.

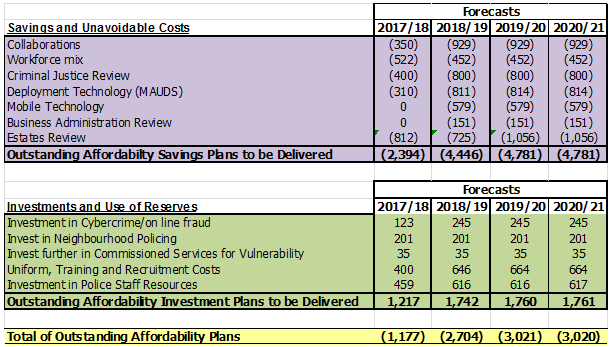

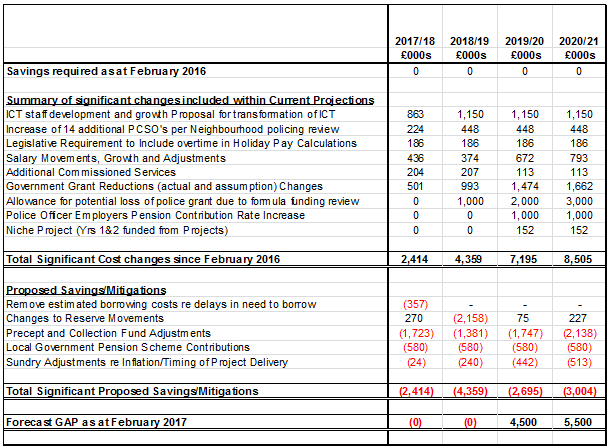

4.6 A number of changes have either been agreed during the financial year, are proposed to be made or are required as a result of changes to previous assumptions/saving plans and/or inflation/legislation. The impact of these proposed changes which are currently incorporated into this budget and MTFP and are summarised in the table below:

4.7 It is vital to appreciate that there is no capacity to add any additional unfunded growth to the financial plans. Even where savings are identified which appear to be able to fund investments/growth this is not the case given the projected imbalance in 2019/20 and beyond. Our focus over the next 2 years needs to be on delivery of those areas already included within the financial plans and the identification of additional areas of savings and efficiencies to ensure that future years’ financial plans can be balanced.

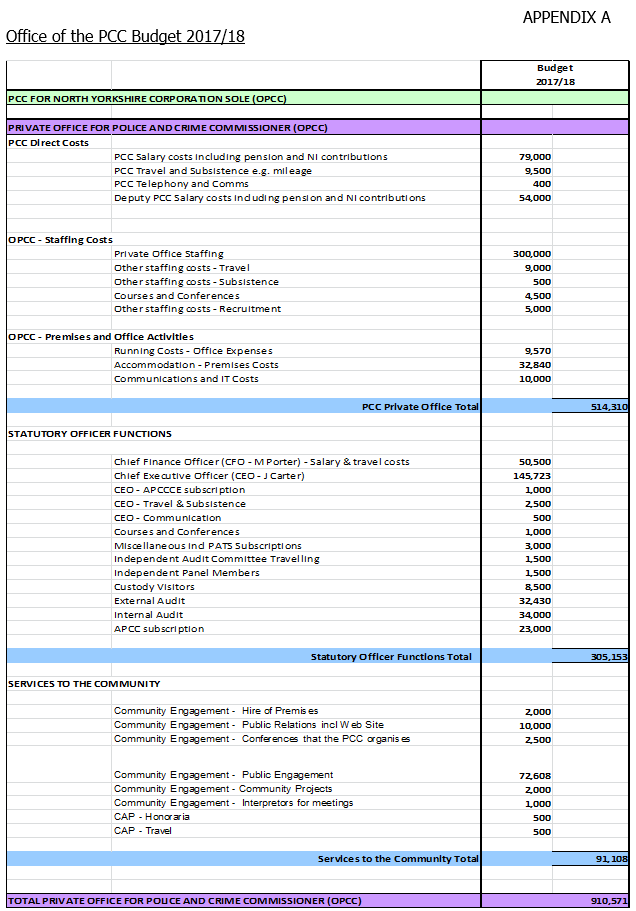

4.8 The Office of the PCC

The PCC’s budget remains at £911k for 2017-18 and is £169k (or nearly 16%) less than the budget when the PCC came into Office in 2012, in cash terms. In real terms (after taking into account inflation) the budget is around £275k lower than in 2012 which in real terms is 25% lower. The detailed budget is set out at Appendix A, below.

4.9 Corporate Services

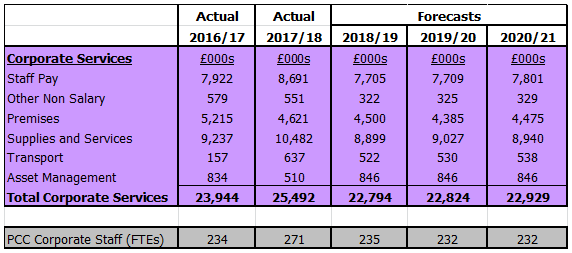

The table below sets out those areas and budgets that remained with the PCC post the ‘Stage 2’ transfer in relation to Corporate Services. The forecasts for the next 4 years are based on decisions made to date and the savings and investment plans set out within this report.

4.10 The significant increase in both staff numbers and overall budget, in 2017-18, relate to the additional resources and costs that are aligned with the significant numbers of projects and capital development that are current underway within the organisation. The above table shows that these are then expected to return to ‘normal’ levels in the years thereafter.

4.11 Commissioning and Partnership Budgets

The role and responsibilities of the PCC is wider than Policing and this has been acknowledged with the addition of responsibilities around Community Safety and Victims and Witnesses services. These additional responsibilities have also attracted some additional funding. The Community Safety grant was provided in 2013-14 before being absorbed into the main Police Grant, while the provision of grant funding from the Ministry of Justice for the commissioning of services in relation to Victims and Witnesses services continues.

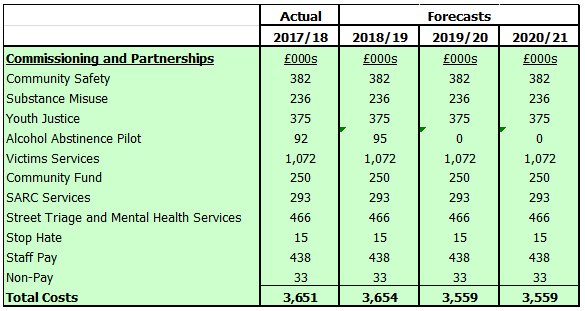

4.12 The budgeted investment in these areas and other areas of Partnership work are set out below. As with any areas of the budget these are subject to review and change in line with the needs of the community and the priorities within the Police and Crime Plan. Therefore while the 2017/18 budget is well defined, the future years should not be taken as a guarantee, by those in receipt of funding, that it will automatically continue beyond any contractual arrangements that currently exist.

4.13 Police Force

As expected the vast majority of the funding received by the PCC is provided to the Chief Constable. The Chief Constable is accountable to the law for the exercise of police powers, and to the Commissioner for the delivery of efficient and effective policing, management of resources and expenditure by the police force.

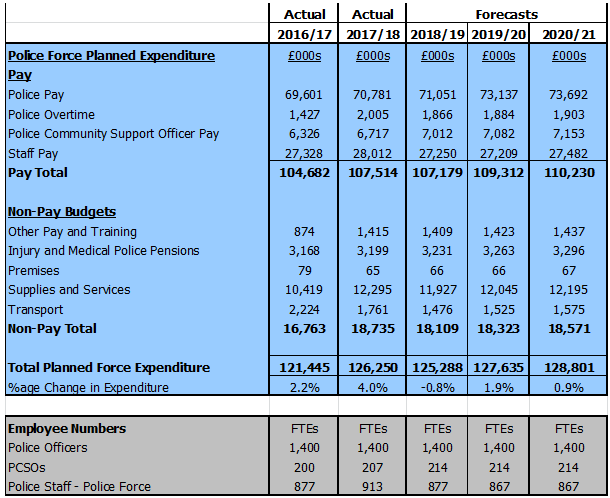

4.14 Based on the current split of resources and responsibilities between the PCC and CC the CC has modelled a budget for 2017-18 and beyond based on the ambition of achieving 1,400 FTE Police Officers and 214 FTE PCSOs. The current position is outlined in the table below:

5. Overall Financial Summary

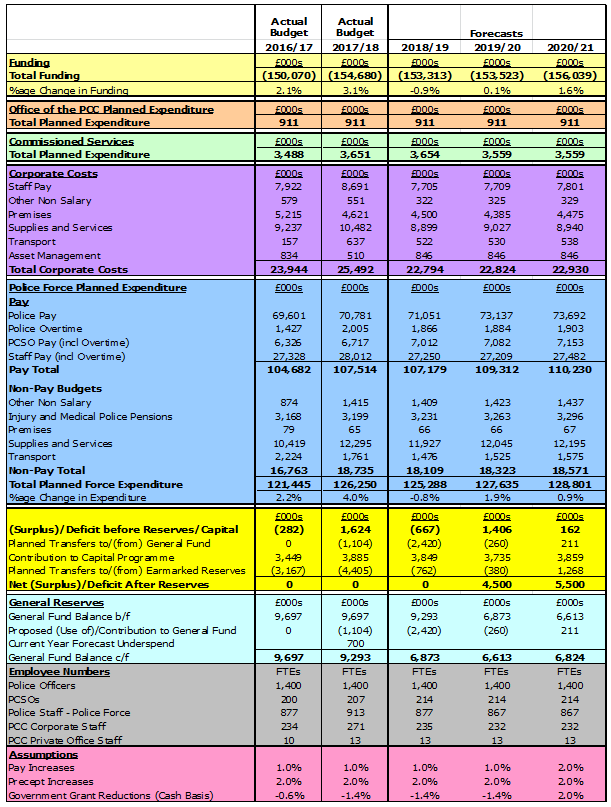

5.1 Based on the assumptions outlined within this report the summary position, over the next 4 years, would be as illustrated in the table below:

5.2 The MTFP set out within this paper for approval is balanced for the next 2 years, it provides a stable platform from which to invest in areas of priority within the Police and Crime Plan, particularly vulnerability, and if current and future plans are delivered in a co-ordinated and planned way should continue to drive efficiency and effectiveness within the organisation which in turn should aid investments in future years. It is vital to appreciate though that around £3m worth of recurring additional costs have been added into the underlying budget over the last 12 months. These were primarily as a result of decisions made by the organisation and not unavoidable costs.

5.3 This is not something that the organisation can continue to do. Savings need to be developed to balance the plan in the first instance and the organisation needs to think very carefully before agreeing to any additional items of growth until firm and deliverable plans are developed to balance the budget for 2019/20 and beyond.

6. Capital Financing and Expenditure

6.1 The assets owned by the PCC are a vital platform for the delivery of the Police and Crime Plan, with the overall purpose of the capital plan to provide sufficient funding to renew the asset base of the organisation, informed by condition deficiency surveys, ‘fit for purpose’ reviews, equipment replacement programmes, business continuity requirements and invest to save expenditure. Plans have been drawn up and are being developed for capital investment which would aid the organisation in delivering against the Police and Crime Plan.

6.2 Capital Grant

The PCC is expected to receive only £431k in terms of Capital Grant in 2017/18, this is £71k, or 15%, lower than in 2016/17 and nearly 60% lower than it was in 2014/15. If the PCC wants, or needs, to spend more on Capital Expenditure than this Grant provides then the options are as follows:

- Borrowing money (either through loans or from current cash balances) to fund Capital Purchases.

- The sale of Capital Assets resulting in a Capital Receipt.

- A contribution from the Revenue Budget

- The Use of Reserves

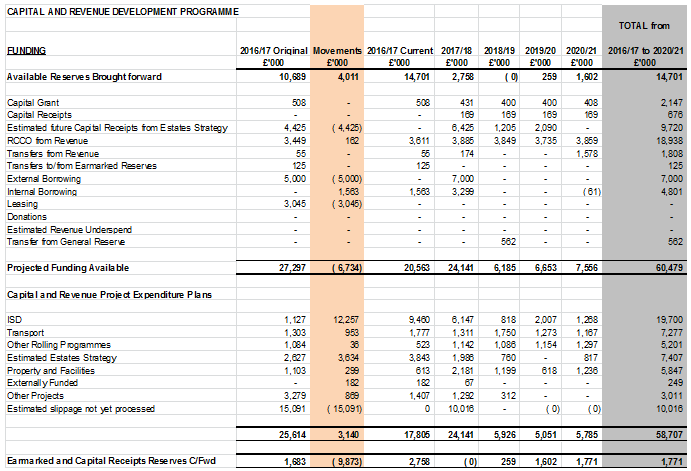

6.2 At the end of 2015/16 the PCC had reserves set aside for Capital that totalled £14.7m. The table below shows how this is planned to be utilised over the coming years.

6.3 Since the February 2016 budget was approved a further £3.14m worth of schemes were approved during the year and added to the overall 2016/17 plan. Some of these will be funded from external sources, while others will be funded from revenue savings but nonetheless this is a significant amount of in year additionality and is not something that the organisation can afford to continue in 2017/18 and beyond.

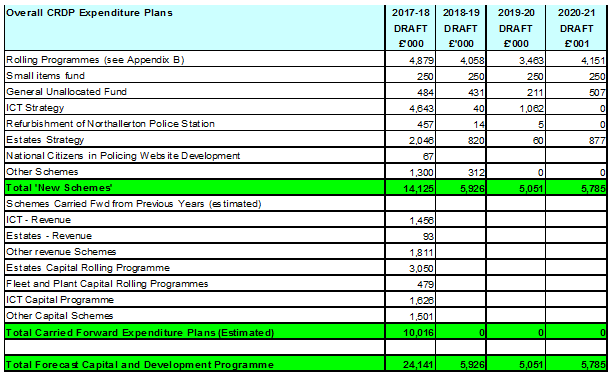

6.4 The financial implications of those additional approvals have been incorporated into the Capital plans as set out below.

6.5 The timing of the delivery of some of these plans needs to be reviewed to mitigate significant levels of slippage between financial years. The revenue consequences, both in terms of the savings that are expected to be delivered from the implementation of both the Estates strategy and the wider investment plans along with the costs of borrowing to fund the Capital programme have been incorporated into the overall MTFP.

6.6 It is important to recognise the forecast slippage of just over £10m (which is likely to grow when final figures are available for 2016/17), between 2016/17 and 2017/18 which follows on the back of £15m of slippage between 2015/16 and 2016/17. This recurring trend, when added to the new year schemes means that in excess of £24m of Capital and Revenue Development Schemes are due to be delivered in 2017/18. This is highly ambitious and based on recent experience very unlikely to be delivered.

6.7 As I mentioned last year the organisation needs to consider the scope and volume of how many schemes are currently factored into the next financial year and whether they all can be delivered.

6.8 It is also vitally important that there is no scope for any new schemes that are proposed in year to be accommodated within the budget for 2017/18 unless these are minor in nature – so less than £25k – which could be funded from the small items fund.

6.9 The CIPFA Prudential Code of Practice is a key element in the system of capital finance. Under this system individual PCC’s are responsible for deciding the level of their affordable borrowing having regard to the prudential code. The associated decision note ‘2017/18 Prudential Indicators and Treasury Management’ will provide the PCC with reasonable assurance that the proposed Capital Plan and its financing are within prudential limits.

7. Reserves and Risks

7.1 A specific report from the PCC CFO in relation to the Robustness of the Estimates within the MTFP and the Adequacy of the Reserves covers reserves and risks in more detail and the PCC is asked to consider and take note of this report prior to approving the 2017/18 Budget and MTFP.

8. Consultations Carried Out

Given the process that under pins the development of the Budget and the wider MTFP, including Capital and Revenue Development Programme, the PCC CFO did not feel there was any benefit in any internal consultations on the specific contents of this Decision Notice although there has been significant input into the overall plan from across the organisation.

9. Compliance Checks

Financial Implications/Value for money:

This Decision Note has been compiled by the Chief Finance Officer for the PCC and therefore the financial implications are outlined within the report and reflect the comments, advice and recommendations of the post holder. The PCC CFO is also content that there are no legal or HR implications resulting from this Decision Notice and therefore has not sought specific feedback on these areas. It is the underpinning business cases, recruitment plan and business plans that will pick up the specific impact with the organisation as needed.

Public Access to information

As a general principle, the Commissioner expects to be able to publish all decisions taken and all matters taken into account when reaching the decision. This Notice will detail all information which the Commissioner will disclose into the public domain. The decision and information will be made available on the Commissioner’s website.

Only where material is properly classified as Restricted under the Government Protective Marking Scheme or if that material falls within the description at 2(2) of The Elected Local Policing Bodies (Specified Information) Order 2011 will the Commissioner not disclose decisions and/or information provided to enable that decision to be made. In these instances, Part 2 will be used to detail those matters considered to be restricted. Information in Part 2 will not be published.

All decisions taken by the Commissioner will be subject to the Freedom of Information Act 2000 (FOIA).

Part two

Is there a Part 2 to this Notice – NO

Report Information

- Author(s) and Executive Group Sponsor: Michael Porter, PCC Chief Finance Officer

- Date created: 16 February 2017

I confirm that all the above advice has been sought and received against this and any associated Part 2 information and I am satisfied that this is an appropriate request to be submitted for a decision

Signature: Michael Porter Date: 28 February 2017

Appendix A

- Published on