003/2016: 2016/17 Precept Proposal (local policing tax) – 28 January 2016

Executive Summary and Recommendation:

This is a Decision Notice outlining the Commissioner’s proposals for the police precept, or local policing tax.

Legislation requires that the Police and Crime Commissioner (PCC) agrees their budget and associated precept and basic council tax for the forthcoming year before 1st March each year. However before doing so the PCC must notify the relevant Police and Crime Panel, by the 31st January, of the precept which they propose to issue for the following financial year.

The PCC has been informed by the Government that ‘Total central Government resource funding to policing, including funding for counter terrorism, will be reduced by 1.3% in real terms over four years. Taking into account the scope that you have to raise local council tax, this means a flat real settlement for policing as a whole.’ This is very important because it means that any policing area which decides to freeze the local policing precept will in reality have its funding cut. And that ‘You should plan on the basis that the overall referendum limit for police precept will be maintained at 2% over the Spending review period for Police and Crime Commissioners in England.’

The results of consultation with the public of North Yorkshire in relation to the level of precept for 2016/17, which had 1,745 responses, has resulted in 66% voting for an increase of at least 1.99%, with 61% voting for a precept increase of 1.99%, 5% voting for an increase above 1.99% and 34% voting for a precept freeze.

The current financial plans of the organisation for 2016/17 included a planning assumption of an increase in precept of 1.99%. This would provide just over £1.2m of recurring funding to spend on Policing and Crime above the option of a precept freeze.

It is therefore recommended that the Commissioner gives approval to propose, to the Police and Crime Panel, the Police Precept for 2016/17 as £217.00, for a Band D property within North Yorkshire. This would be an increase of 1.99%, or £4.23 per annum (around 8 pence per week), from the 2015/16 level.

Decision

Police and Crime Commissioner decision: Approved

Signature:

Date: 28 January 2016

Title: Police and Crime Commissioner

1. Introduction and Background

The balance of cost of the police service not paid for by central government is met by local taxpayers through a precept on their council tax. It is the responsibility of the eight local billing authorities namely, Craven District Council, Hambleton District Council, Harrogate Borough Council, Richmondshire District Council, Ryedale District Council, Scarborough Borough Council, Selby District Council and York City Council to collect this.

Legislation requires the precept for 2016/17 to be set before 1st March 2016. The precept on each of the eight billing authorities is set taking account of their individual surpluses/deficits on collection funds.

The PCC’s attention is drawn to the following:

- The police and crime commissioner must notify the relevant police and crime panel of the precept which the commissioner is proposing to issue for the financial year (the “proposed precept”) by the 31st January 2016.

- A Police and Crime Panel (PCP) can veto the proposed precept from the PCC if 2/3rds of the Membership of the panel vote to do so.

- The PCP are required to issue a report to the PCC on the proposed precept, by the 8th February 2016, including any recommendations that they may have on the proposal and also whether they have voted to veto the proposal.

- If the PCP do not veto the proposed precept:

The PCC must:

- Have regard to the report made by the panel including any recommendations in the report,

- Give the panel a response to the report and any recommendations; and

- Publish the response.

The PCC may then:

- Issue the proposed precept as the precept for the financial year, or

- Issue a different precept, but only if it would be in accordance with a recommendation made in the report to do so.

- If the PCP veto the proposed precept then the PCC must not issue the precept and further steps must be undertaken in line legislation. Further information will be provided on this should it be necessary.

- A police and crime commissioner may not issue a precept under section 40 of the Local Government Finance Act 1992 for a financial year until the end of this scrutiny process is reached.

2. Consultation

To further inform the decision around the proposed precept for 2016/17 consultation has been undertaken with the Public to ascertain their feedback and thoughts on this subject.

The public were asked ‘which of these statements best reflects your views on this proposal?’ There were three options:

- Freeze the precept – meaning no more to pay locally, but harder for the police to deliver services and balance the books

- Increase it by 1.99 per cent – in order to raise just over £1.2 million for next year and subsequent years, but avoid a costly local referendum, or

- Increase it by more than two per cent – which could raise more money, but would mean at least £700,000 would need to be spent on a referendum on the proposals.

The results from this consultation, based on the 1,745 responses that made a choice, were:

- 34% thought that precept should be frozen.

- 61% thought that the precept should increase by 1.99%.

- 5% thought that the precept should be increased by more than 1.99%.

The consultation was undertaken in numerous ways. Hard copy leaflets were sent to all police stations and local libraries, a survey was available on the Commissioner’s website, and there was also an independent telephone survey. The results of the consultation, broken down into the above parts, as well as taken together, can be seen in Appendix 1.

3. Contribution to Police and Crime Plan Priorities

The recommendations in this Decision Notice are offered on the basis that they support the finances of the organisation and therefore underpin all of the Police and Crime Plan priorities.

4. Financial Implications

The Tax Base

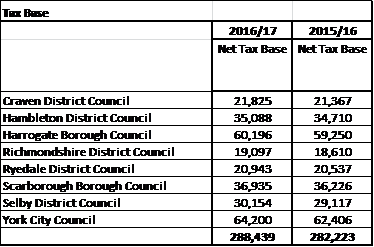

The eight local Councils have notified the PCC of their tax bases for 2016/17 as set out in the table below:

The tax base is expressed in terms of Band D equivalent properties. Actual properties are converted to Band D equivalent by allowing for the relevant value of their tax bands as set down in legislation (ranging from 2/3rds for Band A to double for Band H; discounts for single person occupation, vacant properties, people with disabilities etc;) and a percentage is deducted for non-collection. Allowance is also made for anticipated changes in the number of properties.

The tax base calculated by the billing authorities differ from the figures used by the Government (which assumes 100% collection) in calculating Grant Formula entitlements.

As can be seen from the table above the number of Band D equivalent properties across North Yorkshire has increased in 2016-17, in comparison to 2015-16, by 6,216 – this equates to an increase of 2.2%.

The financial impact of this permanent increase in the number of calculated Band D properties of 6,216 is a recurring increase in precept funding of £1,349k from 2016/17 onwards, which has helped to reduce budget reductions and savings.

The 2016/17 tax base is therefore 288,439 Band D Equivalent properties.

Setting the Council Tax

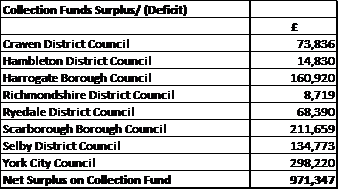

The precept calculation needs to take account of any net surplus or deficit on the billing authority collection funds. Projected surplus/deficits on the individual funds are shown in the table below.

The surpluses that have arisen need to be returned through the precept. The final precept to be levied will reflect the position on each council’s collection fund.

In the 6 years prior to the Localisation of Council Tax benefits, the overall surplus on the collections funds of the 8 Councils, average just under £140k per annum. In 2014/15 the collection surplus increased to £385k, in 2015/16 this increased to £757k and as can be seen from the above table the amount to be paid in 2016/17 is £971k.

This results, in part, from more information now being available on the impact of the Localisation of Council Tax benefit scheme, the implementation of new powers on council tax and tax base growth. There is however no guarantee that this level of surplus will continue into future years and therefore the current financial plans assume a surplus on the collective collection funds of £150k per annum across the eight councils.

Financial Summary:

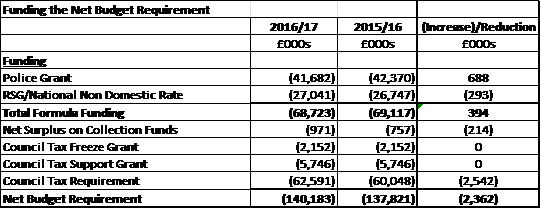

Net Budget Requirement

Based on the proposed precept increase of 1.99% the Net Budget Requirement (NBR) [This is the amount the PCC estimates as its planned spending, after deducting any income it expects to raise from fees and charges, specific grants from the Government and any movements on reserves.] for 2016/17, in comparison to 2015/16, is set out in the table below:

As can be seen from the above the NBR is expected to increase in 2016/17, by nearly £2.4m (or 1.7%,) if the precept is increased by 1.99%. While this is significantly better than the organisation was planning, it is worth noting that the following unavoidable additional costs to the organisation in 2016/17, in comparison to 2015/16, more than absorb all of this increase:

- Increased National Insurance Charges resulting from National Pension Changes – £2.0m

- National Pay Award agreements – £1.0m

- Requirement to include Overtime in Holiday Pay calculations – £0.3m

Therefore despite a significantly better government grant settlement than previously forecast there is still a need for the organisation to generate savings, to not only balance the budget but also to aid investment in priority areas. Any change to the proposed 1.99% increase in precept would therefore increase the savings needed and/or require reduced services.

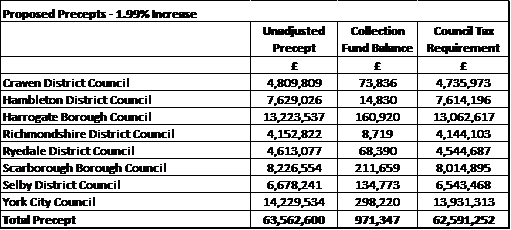

Precept Calculations

The final precept calculations are set out in the tables below based on a 1.99% increase:

The ‘basic amount’ of council tax is the rate for a Band D property. It is calculated by dividing the Council Tax Requirement by the total tax base i.e. £62,591,252 by 288,439 giving a council tax rate for Band D properties of £217.00.

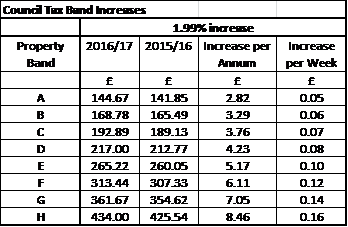

The proposed council tax rate for each property band is determined in accordance with the statutory proportions and is set out in the table below. It is advised that the tax rates should be calculated to more than 2 decimal places.

The impact of a 1.99% increase in the ‘Police’ element of the council tax is shown in the table below.

5. Consultations Carried Out

The below table should include who has been consulted and their feedback. Not all departments will need to be consulted with on every proposal, however, they should all be considered:

| Name | Department | Comments |

| Will Naylor | Office of the PCC | No |

| Jane Palmer | Financial Services | No |

| Lisa Winward | Local Policing | No |

| Lisa Winward | Beyond Local Policing | No |

| Leanne Consett | Human Resources | No |

| Jane Wintermeyer | Joint Corporate Legal Services | No |

| Louise Wood | Corporate Communications | No |

| Jonathan Garrett | Property and Facilities | No |

| Sudeep Chatterjee | Information and Communications Technology | No |

| Bob Brigginshaw | Transport | No |

| Jenni Newberry | Joint Corporate Commissioning and Partnership Services | No |

| Nicola Johnston | Procurement | No |

| Maria Earles | Organisation and Development | No |

| Sarah Wintringham | Information Management | No |

5. Compliance Checks

Financial Implications/Value for money:

This Decision Note has been compiled by the Chief Finance Officer for the PCC and therefore the financial implications are outlined within the report and reflect the comments, advice and recommendations of the post holder.

Legal Implications:

Having read this report and having considered such information as has been provided at the time of being asked to express this view, the Acting Force Solicitor and Head of Legal Services is satisfied that this report does not ask the PCC for North Yorkshire to make a decision which would (or would be likely to) give rise to a contravention of the law.

Human Resources Implications:

The content of this report are noted, the only implications of not agreeing proposals would be the potential negative impact upon ‘People First’ Police and Crime Plan deliverables.

Public Access to information

As a general principle, the Commissioner expects to be able to publish all decisions taken and all matters taken into account when reaching the decision. This Notice will detail all information which the Commissioner will disclose into the public domain. The decision and information will be made available on the Commissioner’s website.

Only where material is properly classified as Restricted under the Government Protective Marking Scheme or if that material falls within the description at 2(2) of The Elected Local Policing Bodies (Specified Information) Order 2011 will the Commissioner not disclose decisions and/or information provided to enable that decision to be made. In these instances, Part 2 will be used to detail those matters considered to be restricted. Information in Part 2 will not be published.

All decisions taken by the Commissioner will be subject to the Freedom of Information Act 2000 (FOIA).

Part two

Is there a Part 2 to this Notice – NO

Report Information

Author(s) and Executive Group Sponsor: Michael Porter, PCC Chief Finance Officer

Date created: 26 January 2016

Background documents:

I confirm that all the above advice has been sought and received against this and any associated Part 2 information and I am satisfied that this is an appropriate request to be submitted for a decision

Signature: Michael Porter

Date: 26 January 2016

Appendix A

Report on Police Precept Consultation

- Published on